Want to improve productivity and contain costs? Consider this…healthcare payers continue to grapple with how to reduce costs by improving the accuracy of claims payments or payment integrity. Traditionally, cost containment measures in this space rely on retrospective post-payment or pay and chase methods.

The Problem:

Pay and chase requires tedious, manual review of claims and costly efforts to try to recover monies erroneously paid. Follow-up activities such as phone calls, letters and even legal action can significantly erode the original value of a claim. In an effort to reduce dollars and resources spent to recover money from erroneously paid claims, many U.S. healthcare providers resort to reviewing only high-dollar claims, leaving millions of dollars on the table, never to be seen again and directly impacting their bottom line.

Payers that once presumed they could not afford the investment in prevention now realize that market forces and internal financial pressures to contain costs make the need to identify and prevent unnecessary claims payments an enterprise imperative.

The Good News:

Advances in analytics and machine learning to predict and preempt erroneous payments offer a new approach to cost containment that improve productivity, reduce time spent manually reviewing claims, and reduce the number of erroneous payments that are difficult to recover.

New technology and techniques offer a solution that transform how payers address improper payments from a retrospective approach to prospective and even more impactful, preemptive approaches.

Retrospective, Prospective, Preemptive, Oh My!

What does all this mean? As explained above, pay and chase approaches are outdated and help recover just a small fraction of monies erroneously paid. Prospective approaches aim to detect improper claims before they are paid. Even better, preemptive approaches actually predict and preempt a claim from being paid erroneously by flagging a claim in pre-adjudication, saving it from being added to a long and ever-growing roster of claims requiring manual review.

Issues that lead to erroneous payments are varied - from duplicate claims to Other Party Liability (OPL), new technologies offer a solution for many of the leading factors attributing to this problem.

The Best Part:

Healthcare payers can leverage solutions with data they already have - historical claims data.

How Does This Benefit Payers:

Well, by engaging a partner such as xScion, there is no heavy lift on the payer’s part to implement modern measures to improve payment integrity. In many cases, all of the information that is needed to predict and preempt erroneous payments are contained within existing claims data.

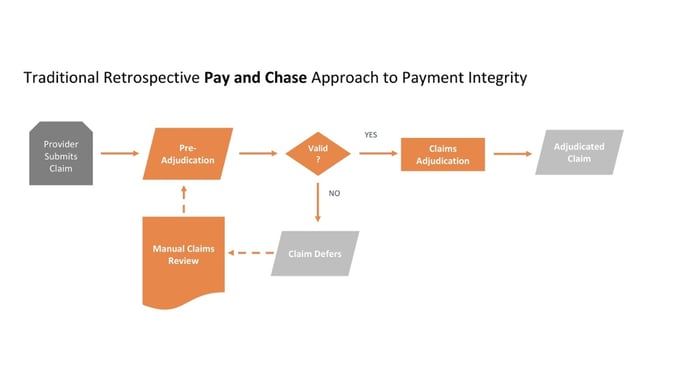

Does Your Current Approach to Payment Integrity Look Something Like This?

Erroneous claims defer and require time intensive manual review or worse. Claims are paid erroneously, with just a fraction resulting in a recovery.

If this resonates in your organization, consider this: Imagine a solution that auto-resolves certain payment integrity root causes, greatly reducing the number of claims that wind up on the dreaded Manual Claims Review roster. This is a time and productivity KILLER!

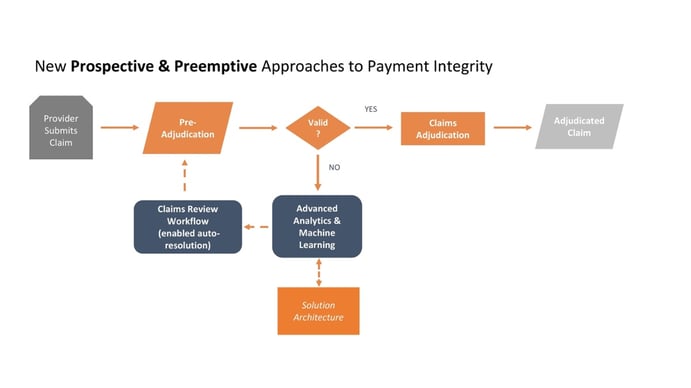

What if Your Technology Approach Could Look Like This Instead?

Here, a health payer can supplement their post-payment, retrospective solutions with effective prospective detection and preemptive prevention techniques that can examine hundreds or thousands of variables, uncovering previously unknown and emerging patterns, and claims anomalies that traditional rules-based analytics may not recognize. Let the machines do the complicated review and calculations to enable auto-resolution of claims deferrals, saving your team time and money; actual dollars saved improving your bottom line.

I wrote a previous article about how advanced analytics and machine learning are being used to maximize the data assets of a healthcare payer to address, for example, claims that are missing provider data. Imagine if you could reduce the number of these types of claims that are improperly paid by upwards of 80-90%. Imagine an investment in these predictive and preemptive technologies that will pay dividends and pay for itself within a year! This is entirely possible with today’s new use of these technologies.

“But, I Already Use Multiple Payment Integrity Vendors!”

If this sounds like you, it may be time for a payment integrity revival. Gartner said it best when they reported that “2018 is ripe for a payment integrity renaissance”. Traditionally, many providers employ multiple payment integrity vendors and solutions, each supporting a different business unit or targeting a specific use case (e.g. duplicate claims, subrogation, coordination of benefits, auditable claims, and claims with missing data). This is called a “stacking” approach that is more costly to purchase and maintain over time, often resulting in similar or redundant services being provided across the organization. If cost containment is at top of mind, it is worth a review of payment integrity vendors and solutions from the enterprise perspective.

Top 5 Considerations for Evaluating Stacked Payment Integrity Solutions across the Enterprise

- Determine the value of current payment integrity approaches across the enterprise. This involves engaging stakeholders across multiple business units and understanding the specific related problems they are trying to resolve.

- Perform and in-depth ROI analysis to uncover the true costs and value offered by each vendor as it relates to each business problem.

- Evaluate payment integrity vendor capabilities and align them with your individual business objectives and business problems.

- Ensure that the vendor you choose has the capability to hone in on pre-claims payment prospective and preemptive techniques, in addition to traditional retrospective approaches.

- Identify opportunities to streamline payment integrity capabilities by consolidating the tools and techniques used to tackle erroneous payments.

“But, My Business Doesn’t Have the Resources or Time to Evaluate My Payment Integrity Solutions, Even Though Cost Containment is a Top Objective of My Performance This Year.”

Want to learn more about how we are already helping large health care payers leverage prospective and preemptive approaches to improve payment integrity? Is cost containment one of your primary objectives? Do you want to reduce improper payments to increase revenue? Do you have little time to tackle the challenges involved in solving for payment integrity issues? This is where xScion can help.

Contact xScion today to learn how with minimal investment of your time, we can help your organization improve productivity, reduce costs and improve your bottom line.